To single out Chinese companies for entering into shady business in the DRC is to miss a fundamental point: Western firms have been at it for centuries, and still are.

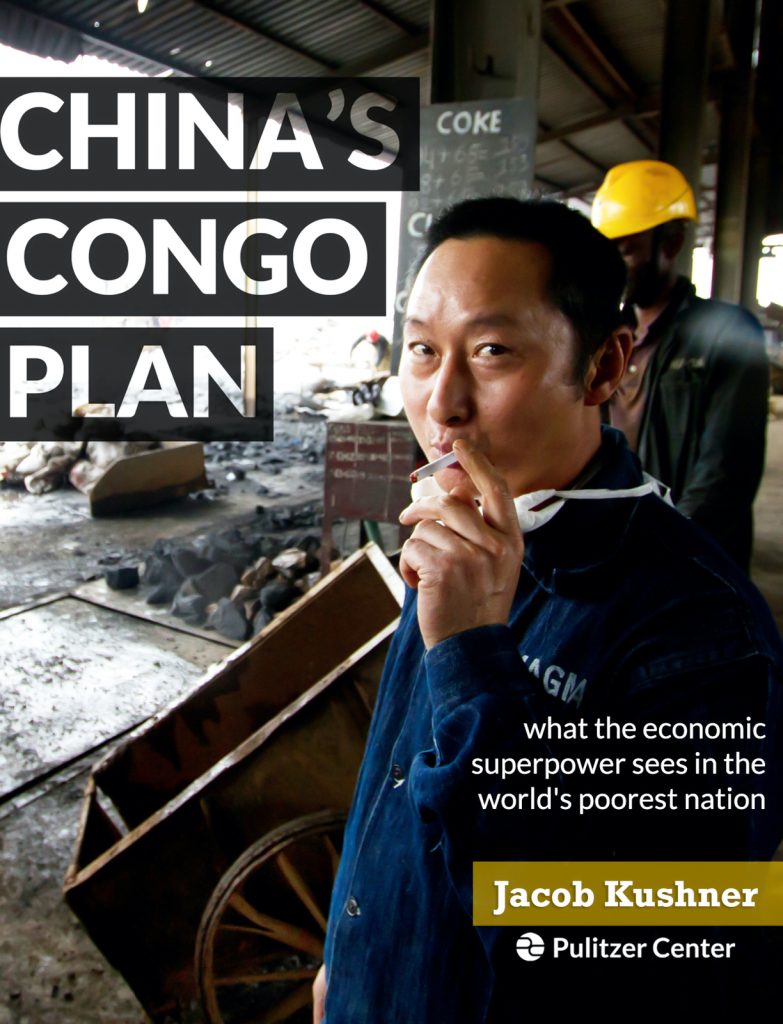

Last January I was in the Democratic Republic of Congo (DRC) to research Sicomines, China’s controversial $6.5 billion megadeal in which Chinese companies will construct roads, schools and hospitals in exchange for mining and untold billions of dollars worth of copper and cobalt with Congo’s state mining agency.

On a sunny morning in the south-eastern mining city of Lubumbashi, I called a Congolese official to pose some hard questions about the deal – particularly, what happened to the $350 million ‘signing bonus’ that was handed over by the Chinese. But I hardly got a word in before his response betrayed his fear as to the more sensitive concern on his mind: “Is this about COMIDE?”

It wasn’t, of course. But perhaps it should have been, because the corruption scandal that burns hottest among Congolese officials today has nothing to do with the Chinese. In 2009, the International Monetary Fund started a $551 million loan to improve the DRC’s business climate through a series of projects. As a condition of the loan, Congo’s government would have to make all its mining contracts and transactions public.

So it must have come as a surprise to the IMF when Bloomberg revealed the DRC had sold its 25% stake in a copper mining venture called COMIDE SPRL – a trade the Congolese government hadn’t disclosed. The IMF responded to the news by refusing to renew the loan, meaning the DRC will essentially forfeit an incredible $225 million because a few Congolese officials didn’t want the world to know what they were up to.

Read the full story as it appeared at Think Africa Press.