“Kushner is fair-minded and has invested much time and effort in figuring out the interplay between the new superpower and a poor but strategically important African country.”

-Ian Johnson, The New York Review of Books

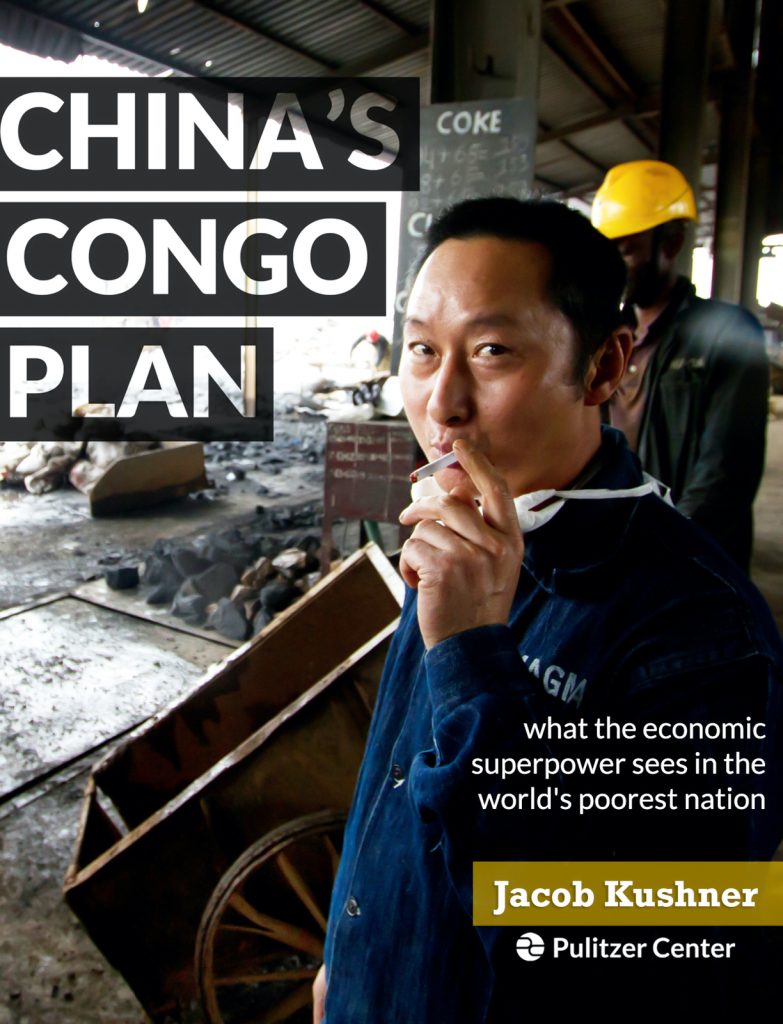

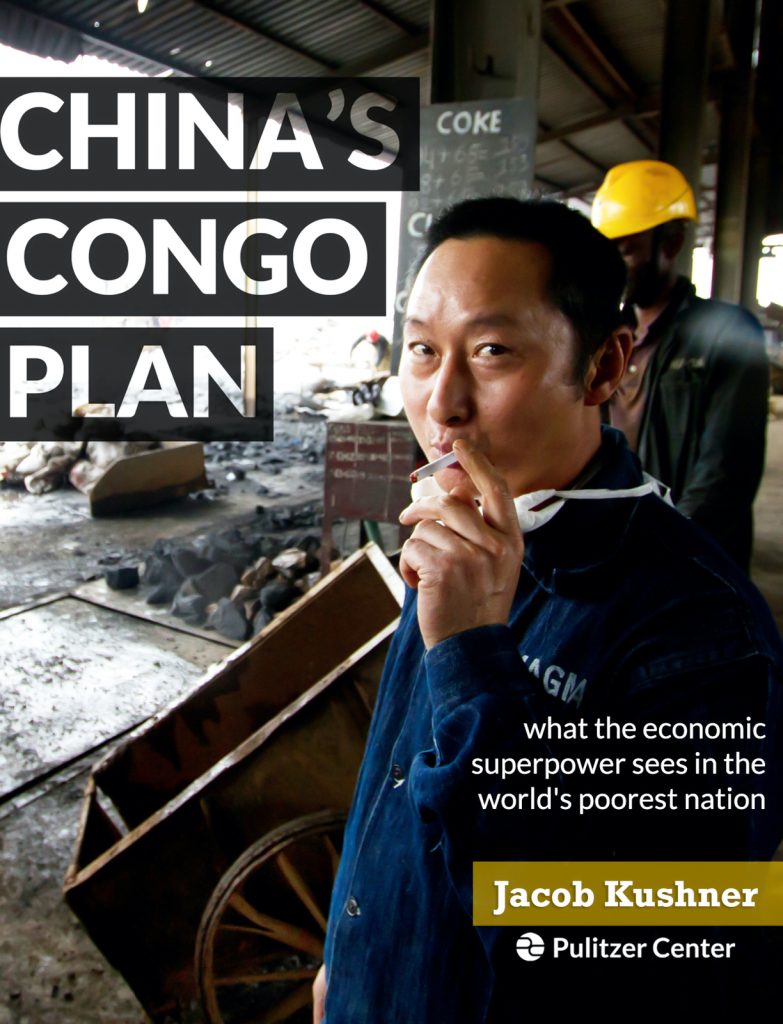

What does China see in the world’s poorest nation? An opportunity for big business. Congo is known for poverty and conflict, but it is home to an enormous wealth of buried minerals such as copper, whose value is rising on the world market. Already, tens of thousands of Chinese men and women have left their families behind to live in Africa to dig and process ore.

Now, two Chinese state-owned companies are opening the biggest mine Congo has ever seen. In exchange, they’re spending billions of dollars to build new roads and modernize Congo’s infrastructure.

But will Chinese mines and roads help transform Congo in a way Western aid and business have not? Or will Chinese businessmen and Congolese officials get rich while the people continue to live in poverty?

In “China’s Congo Plan”, Jacob Kushner takes us street-side to a grand, Chinese-constructed boulevard in Congo’s capital Kinshasa, to a mountain range where Congolese men, women and children dig for minerals with picks and shovels, and to a factory where Chinese immigrants melt aqua-blue rocks into molten copper lava. Two years after China overtook the United States as Africa’s largest trading partner, Kushner brings us inside the world of China’s rise in the continent.

Kushner’s reporting was supported by the Pulitzer Center on Crisis Reporting, and his research was advised by faculty at the Columbia University Graduate School of Journalism. “China’s Congo Plan” was awarded the Grand Prize in the Atavist Digital Storymakers Award for Graduate Longform, sponsored by the Pearson Foundation.

Buy the book:

.

.

When Europeans began arriving in the New World at the end of the 15th century, they used the region to source silver, gold, coffee, and wool. Today, China is the foremost trading partner with several Latin American countries, and buys oil from Venezuela, Mexico, and Ecuador; iron ore from Brazil; beef from Argentina; and copper from Chile and Peru.

When Europeans began arriving in the New World at the end of the 15th century, they used the region to source silver, gold, coffee, and wool. Today, China is the foremost trading partner with several Latin American countries, and buys oil from Venezuela, Mexico, and Ecuador; iron ore from Brazil; beef from Argentina; and copper from Chile and Peru.